This post is restricted to paying members. To follow are specific new trade details:

Stock / Symbol: Exxon Mobil / XOM

Strategy: Put Calendar Spread

Trade entry date / price: 23 Nov 2022 / $113.30

Trade exit date / price: 28 Nov 2022 / $109.95

Recap: On the premise that XOM was technically overbought, I put on a 110 strike Put Calendar Spread on XOM. Anticipating a quick or brief move downward by the stock, I utilized a short put expiring in just over a week, paired with a long put expiring in Mar 2023. On entry, the Greeks were roughly: -0.5 Delta, -0.4 Gamma, 9.0 Theta, and 2.1 Vega. What I liked about this trade setup was its long VEGA since XOM's Implied Volatility (IV) was relatively low. The posted trade plan was to exit the trade within 1 to 2 weeks with XOM trading down to the $110 level. In case I was wrong, I had an upside stop at $114.67.

Position Recap:

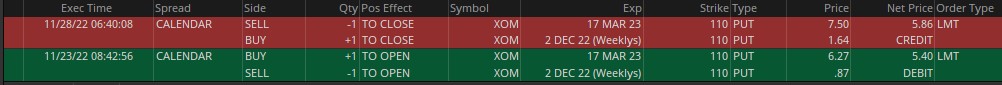

Long 1 XOM 17Mar23 110 put

Short 1 XOM 02Dec22 110 put

Entered for a net debit of $5.40 per contract on Nov 23rd. Exited for a net credit of $5.86 per contract on Nov 28th.

Actual completed trade in ThinkorSwim account:

Analysis:

Max Risk: $540

Max Reward: $180 or 33% with XOM at $110 on Dec 2nd

Margin Requirement: $0

Profit Range: XOM between $106.50 and $114.50 on Dec 2nd

Commission (round trip): $2.60

Realized Profit / Loss: $46 or 8.5% (pre commission)