Stock / Symbol: Overstock / OSTK

Strategy: Vertical Call Spread

Trade entry date / price: 06 Apr 2021 / $66.90

Trade exit date / price: 30 Apr 2021 / $80.90

Entry Reasoning: Technically, OSTK was demonstrating long term support at its 200 day moving average.

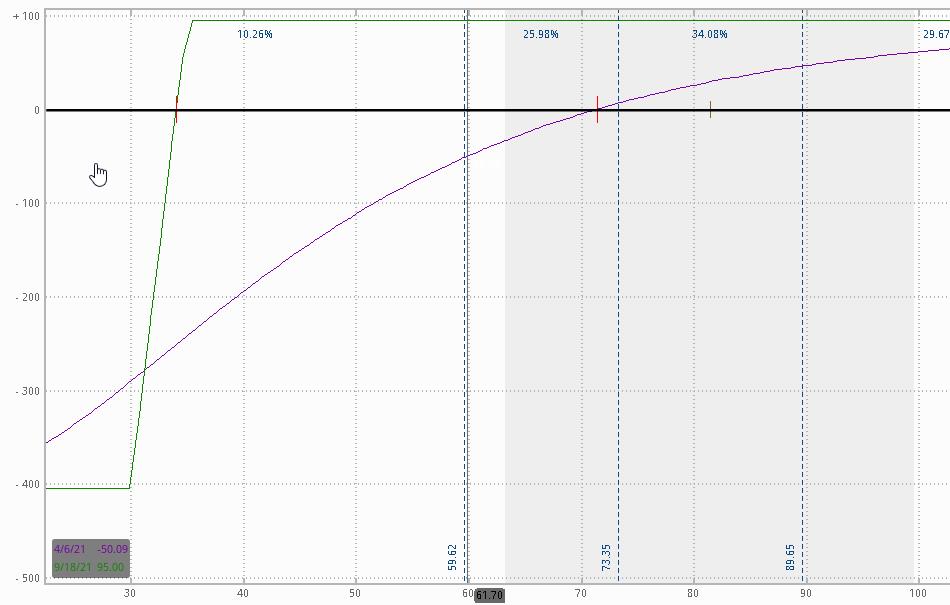

On the premise that OSTK would remain above $35 longer term, I entered into an ITM Vertical Call spread on OSTK, structured to allow for a 48% pullback of the stock and still be profitable.

OSTK Vertical Call Spread structure details:

Long 1 OSTK 17Sep21 30 call

Short 1 OSTK 17Sep21 35 call

for a net debit of $4.05 per contract.

At the time of entry into the position, the Greeks were approximately: 3.5 Delta, 0.7 Theta, and -2.3 Vega. The structuring of the position provided for a profitability range of at/over $34.10 by the expiration of the long/short calls. The plan was to attempt to exit the position early with OSTK trading in the $75 to $85 range.

Exit Reasoning: On Apr 30th, I entered an exit order to attempt to exit the trade early, with about a 15% return. Although I didn't expect the order to fill for at lease a few weeks, it filled that same day at 9:46am PST.

Trade Exit Order:

STC 1 OSTK 17Sep21 30 call

BTC 1 OSTK 17Sep21 35 call

For a net credit of $4.65 per contract .

Analysis:

Max Risk: $405

Max Reward: $95 or 23% with OSTK at/over $35 on Sep 17th

Profit Range: OSTK at/over $34.10 at market close on Sep 17th

Commission (round trip): $2.60

Downside Stop at: $35

Realized Profit / Loss: $60 or 14.8% (pre commission)